Rental seasonality is flattening as peak demand shifts earlier in the year, driven by supply growth and operator strategies.

Written by Valerija I. via CRE Daily <— click here for complete article and similar ones

- Rental market seasonality is flattening, with peak activity occurring earlier in the year.

- Multifamily operators are staggering lease renewal dates to balance occupancy.

- Renter behavior has shifted, with more searches and move-ins happening before summer.

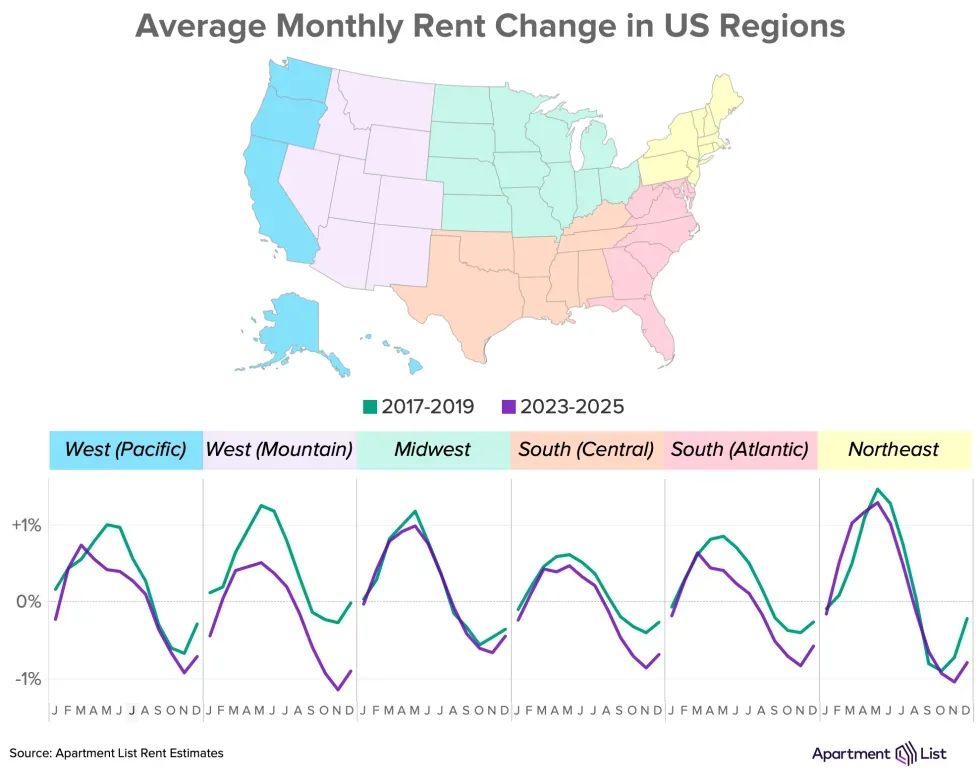

- Regional differences persist, with the biggest changes seen in the Sun Belt and coastal markets.

Rental Market Patterns Evolve

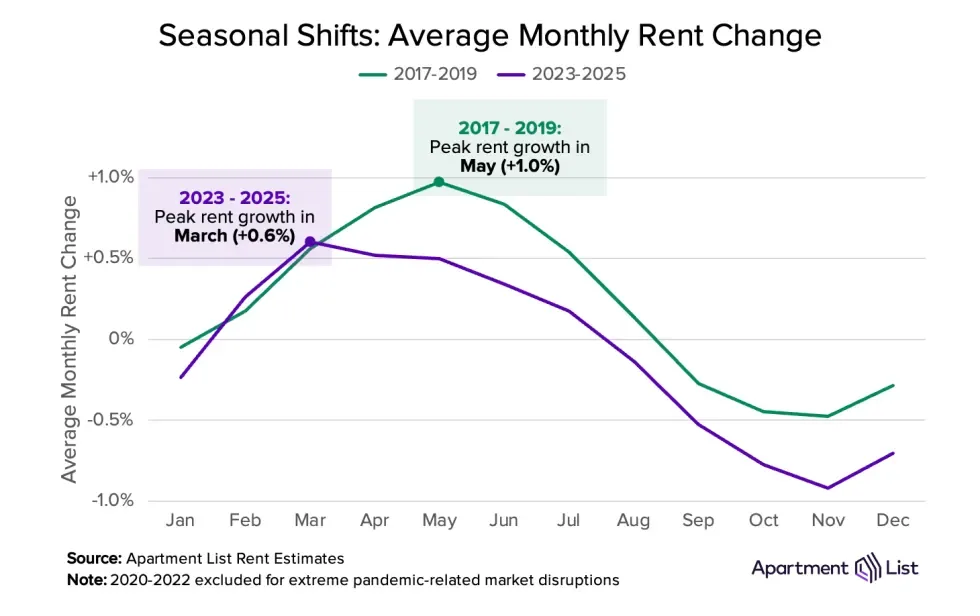

Apartment List reports that the rental market has traditionally seen sharp seasonality, with demand and rent growth peaking in the summer. Recently, this classic seasonal pattern has softened: peak rent growth now occurs earlier in the year, and leasing activity is less concentrated during the summer months.

Three major forces have driven these changes: the pandemic’s disruption of typical moving cycles, multifamily owners proactively spreading out lease dates, and increased apartment supply providing renters with more flexibility and options.

Why Seasonality Is Shifting

Between 2017 and 2019, peak rent growth consistently materialized in May, with rents rising for seven straight months. Since 2023, peak growth has moved to March, is lower than before, and the rent growth period has shortened. The construction boom since 2022, generating over 1M new apartment units, has heightened competition and encouraged landlords to prioritize retention over aggressive rate hikes.

Operators are actively managing lease cycles, often incentivizing non-standard lease terms to avoid vacancy spikes. The 2020 pandemic also reset typical renewal cycles, shifting the timing of move-outs and move-ins. Combined with robust inventory, these factors have diluted the traditional summer peak.

Renter Activity Starts Earlier

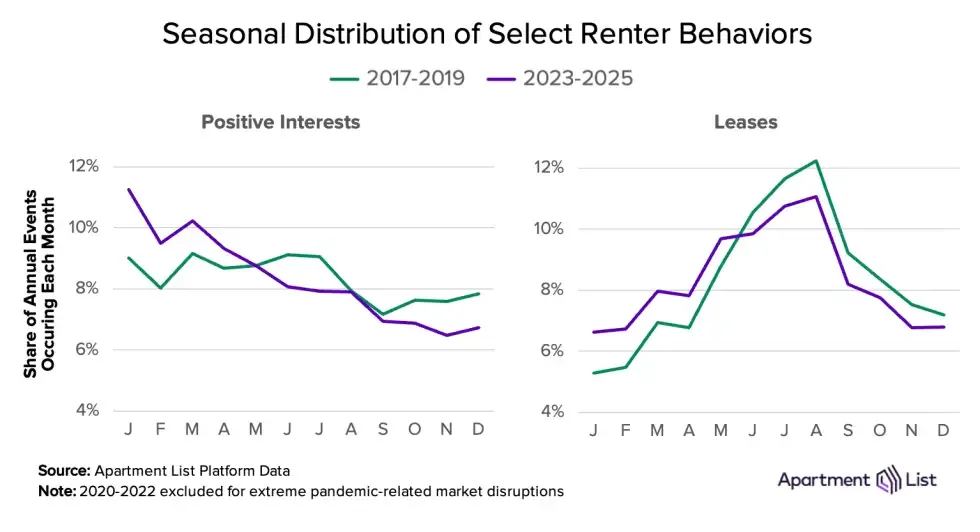

Renter searches and move-ins are now more front-loaded on the calendar. Post-pandemic data shows over 30% of rental property interests occurring in the first quarter, versus a more even year-round distribution previously. Move-ins are also skewing earlier in the year, with more happening between January and May than before.

This change is enabled by technology, remote work, and abundant supply, allowing renters to be more patient and deliberate, often seeking off-season bargains rather than competing in the traditional summer rush. That shift in timing has also opened the door to increased lease savings in fall and winter months, particularly in markets with growing inventory.

Regional Rental Market Variations

Rental market shifts vary by region. Sun Belt and coastal markets, which have seen the most new construction, are experiencing the clearest moves away from the classic seasonal curve, with peaks now appearing as early as March. In the Midwest, the pattern is largely unchanged, though summer peaks are less pronounced. Factors like weather and local supply continue to drive wide differences across cities like Austin, Orlando, and Boston.

Long-Term Outlook for Seasonality

While today’s rental market is supply-driven, some changes—like flexible move timing due to remote work and operator preference for staggered renewals—may persist even after new supply slows. Whether these trends continue depends on shifting market dynamics and ongoing renter and landlord behaviors. For now, the peak season in the rental market is more muted and varied than ever.

If you are considering acquiring more property or selling your income producing assets, then let’s connect.

Dreznin Pappas Commercial Real Estate LLC

Sean Dreznin

Leave a comment