Another informative and insightful article written by Jay Parsons – Click here for complete story.

Apartment operators and investors: Here in 2026, you’re probably gonna hear the terms “gain to lease” and “inverted rent rolls” — terms the industry hasn’t really had to talk about for the last 15 years.

We’ve just recently started to see some of it in heavily supplied markets like Austin and Denver and Phoenix in the second half of 2025. I suspect we’ll hear more about in 2026.

When we’re talking about gain to lease or inverted rent rolls (there’s some differences between the two, but we’ll keep it simple), it basically means this: Your current renters might be paying more than what you’d charge someone new looking at the same type of unit. And then you’re maybe even sending out renewal offer letters at rents MORE EXPENSIVE than what you’d offer to a prospective new lease renter. (Which obviously your residents don’t like — even if they can afford it.)

This creates a big problem for apartment operators. So, how did we get here?

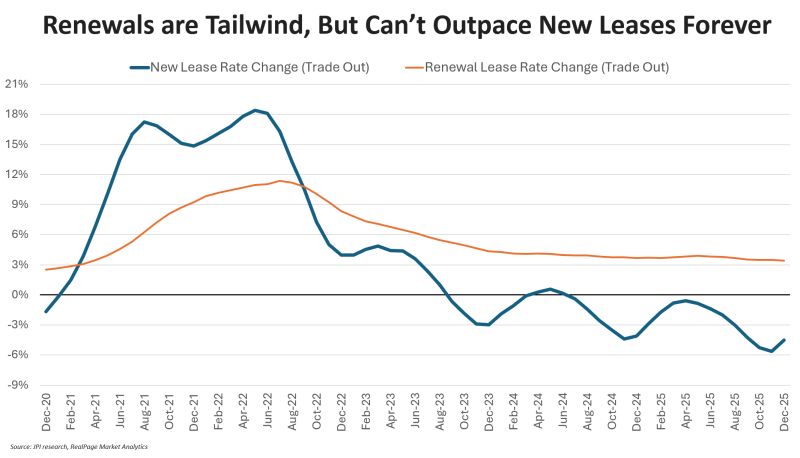

Well if you go back to 2021-22, new leases surged faster than renewal rents. That gap built up what we call LOSS TO LEASE – meaning that current renters were paying much lower rents than a new renter.

But then in 2023-24-25, new lease rents cooled off, and renewals steadily climbed because of that big cushion. Now that gas has evaporated in many markets.

So, what happens from here? Two scenarios:

1) The Big “IF.” … IF new lease rents re-accelerate in the spring, then we’d rebuild some wiggle room here and you could still see renewals increase as well. In that scenario, crisis averted. That’s plausible, but no sure thing.

2) IF new lease rents do NOT re-accelerate in the spring leasing season, operators have to pick between two unattractive options in your renewal pricing strategy:

a) Do you cut your renewal rents to market, via base cuts and/or renewal concessions?

Or

b) Do you push a renewals up 1,2,3%, cross your fingers and hope your renters don’t look at the rents you’re advertising on your website?

Some pros will say renters will pay a modest renewal increase because it’d cost more to move. But it’s not the % increase that matters so much as the nominal difference between the renewal offer and the comparable new lease rents. At some point, the logic breaks.

We’ve all heard the stories of property managers/owners unwilling to give renters the same deals advertised online, so instead the renter moves out of one unit and rents another unit in the same building for cheaper (or moves somewhere else). Now you have more turn costs, more vacancy loss, and when you do fill that unit, you’re not gonna get the same rent you were asking the prior resident to pay. Then you’re just hurting your bottom line just for the gamesmanship of showing positive renewal rents.

Spring leasing is always important, but may be even more so here in 2026.

Leave a comment