Sherwood made a lot of charts this year — here are some of the biggest trends of 2025 and where we think they might go in the 12 months ahead. And no, it’s not just about AI.

Research by David Crowther, Millie Giles, Tom Jones, Hyunsoo Rim, Claire Yubin Oh via Sherwood <— Click here for complete article and all charts.

Not quite so tarrifying?

For the US economy in 2025, perhaps no moment stands more memorable than President Donald Trump unveiling his big board of tariffs on April 2. Though the “Liberation Day” announcement might have come the day after April Fools’ Day, the levies slapped on America’s largest trading partners — as well as some of its smallest — were no joke.

They upended a multi-decade trend of lower trade barriers; took America’s trade-weighted average import tariff to over 25%, its highest level in a century; and blew a multitrillion-dollar hole in the stock market as economists got doomy and gloomy. But while inflation on imported items has certainly ticked up and trade tensions with China have never fully resolved, the US economy has mostly held up OK.

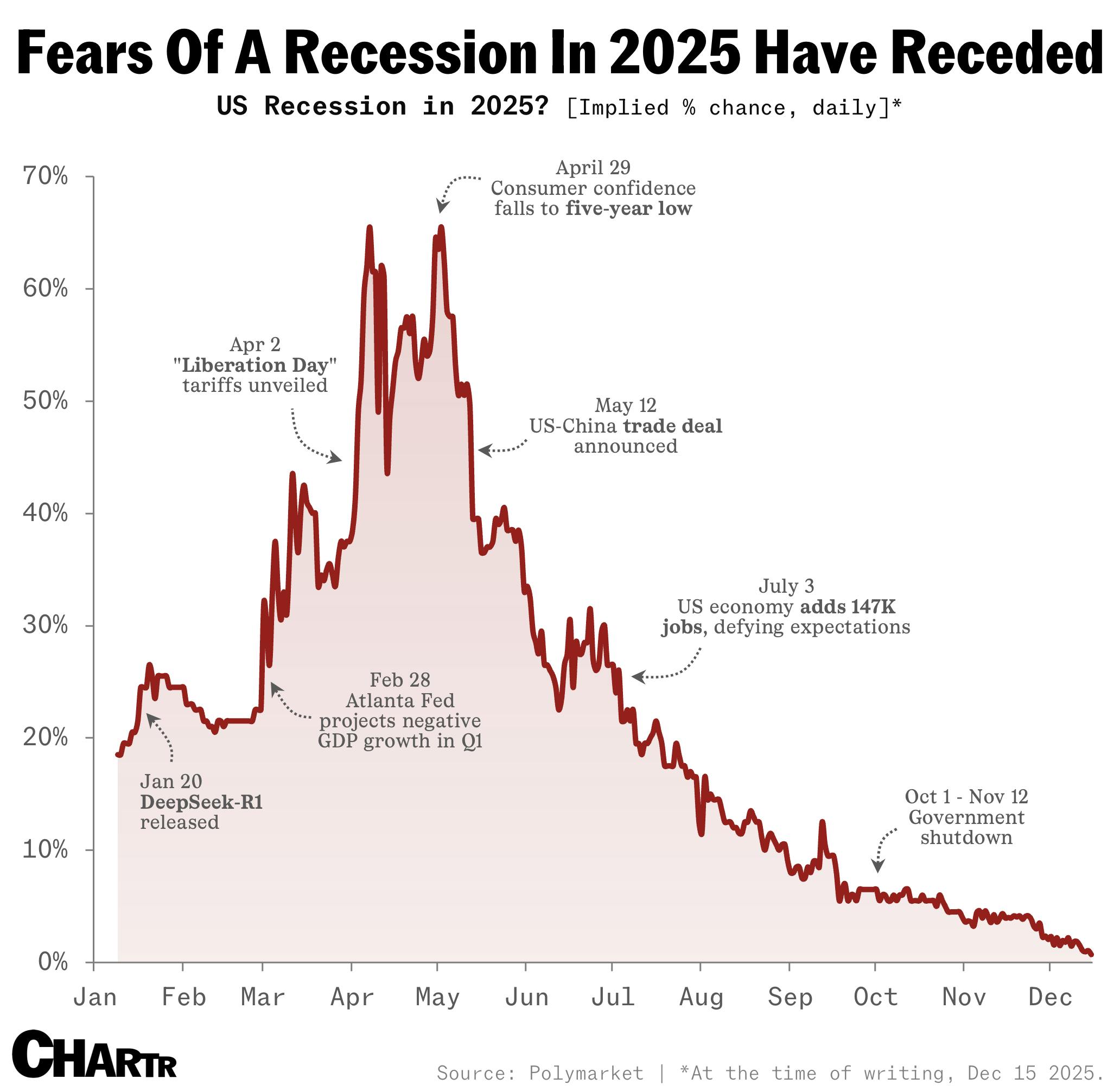

Prediction markets reveal the true extent of the relief. In the spring, contracts on Polymarket were changing hands that priced a ~65% chance of a recession in 2025 — a probability that soon slid on major trade deal announcements, better-than-expected hiring data, and softer inflation. Even the government shutdown wasn’t enough to push things off track, as rampant AI spending helped to boost meager growth in other sectors of the economy.

Looking ahead, it’s hard to see much changing at the national level, at least in the first six months of 2026, as data centers the size of Manhattan crop up in small-town America, creating jobs, infrastructure, and — maybe most importantly of all, at least for the stock market — more AI hype. As long as the models continue to get better, the AI slop keeps coming, and the market stays focused on headline progress rather than the murkier long-term economics of trillions of dollars of up-front investment, next year’s economy might look a little like this year’s. If that’s true, prepare to hear a lot more about the K-shaped economy.

And that’s not the only form of déjà vu we might be experiencing: America’s sense of nostalgia is only growing deeper.

Memory lane has never been busier

With so much change happening all around us, people are increasingly grasping for something familiar. Nostalgia-driven consumption shows no signs of slowing, with everything from music charts to teen wardrobes now tinged with the palpable feeling that we might have been here before. This year saw companies like Build-A-Bear and Gap reap the rewards of tapping into the sentimentalities of the masses, and next year will likely continue the trend.

In fact, the revival of aesthetics like Y2K fashion; the resurrection of analog cameras and physical media music players; and the return of paper-based childhood favorites such as board games and “Pokémon” cards have all resulted in rising search volumes throughout 2025, per Google Trends data.

As Big Tech grows even bigger, it’s likely that the zeitgeist will move further toward simpler, more stable times to equilibrate some dystopic-feeling advancements, which probably means consumers will keep opting for gadgets with vintage vibes and we’ll see older generations of popular tech continue to eclipse modern iterations.

Ironically, the people driving this wistful escapism are often those that weren’t even there for the “good ol’ days” they’re attempting to replicate. But, as we’ve observed over the past year, no one can drive a trend to the point of mania (and sometimes larceny) quite like Gen Z.

The everything market

Las Vegas casino owners might also be hoping for things to go back to how they were.

Indeed, for a place built on carefree hedonism, Sin City has had a miserable year. An October article in The New York Times blamed exorbitant resort prices, eye-watering entertainment costs, a lack of major events, and a drought of international visitors; meanwhile, a superb Slate piece described Vegas’ malaise more as “spiritual rot than pure economic tumult.” Neither spends much, if any, time discussing another, more mechanical threat: that most of us now have a casino in our pocket.

Since the Supreme Court overturned a federal law banning sports betting in 2018, the market has grown to 38 states — the vast majority of which also permit mobile and online gambling — with hundreds of billions of dollars now wagered on sports in America every year and a whopping 48% of American men under 50 reportedly having an account on a digital sportsbook.States like Pennsylvania, one of seven to allow a full legal casino with slot machines and all on your phone, are raking in billions.

Prediction markets, which broke into the mainstream during last year’s election, have only thrown fuel on the fire.

While traders can now invest in contracts tied to everything from the Epstein files, to the next pope, to who is getting fired from the White House, sports has again dominated much of the action — particularly on CFTC-regulated Kalshi, which has struck deals with Robinhood, CNN, and, as of this week, Coinbase.

(Disclosure: Robinhood Markets Inc. is the parent company of Sherwood Media, an independently operated media company. The authors of this article receive Robinhood stock as part of their compensation.)

Hungover arguments at Las Vegas brunches about who will win the Democratic nomination for president, who will take the NBA’s MVP award, or whether James Cameron’s new “Avatar” movie will be a flop are now moving online, and people are increasingly putting their money where their mouth is. With more contracts added on a near daily basis, prediction markets look set to soar in 2026… unless a major insider trading scandal or a change in regulation dampens the mood.

You are what you watch

Should the $83 billion deal course its way through the Paramount- and regulator-shaped obstacles it now faces, the Netflix-Warner Bros. Discovery takeover could completely overhaul our media landscape. For now, though, we’re all doing a fine job of upending things on our own, as traditional formats struggle and social media blurs the lines between “video” and “TV.”

According to Nielsen, YouTube, the new home of the Oscars, took a bigger chunk of US TV watchtime than any other platform in October… which was also the case in every month of 2025 except January, in a clear sign that the content we’re watching on our bigger screens (probably while scrolling on our smaller screens) is shifting rapidly.

Perhaps in part the result of YouTube’s rise — opening monologues, viral video reactions, and chat and game segments make as much sense clipped up online as anywhere else — the fun but formulaic golden age of TV talk shows appears to have faded, as some of the biggest shows shed millions of viewers.

At the box office, a few of the older tricks are still working, luckily for movie theaters. America’s youngest generations keep showing up, with knockout kids movie hits like “A Minecraft Movie,” “Lilo and Stitch,” and “Zootopia 2” helping to prop up cinemas this year. But it’s really been a breakout year for horror as audiences seek out big scares on the silver screen, with the genre taking a record share of the box office in 2025 thanks to hits like “Sinners” and “Weapons.”

For complete article click here <— Sherwood <— Click here for complete article and all charts.

Leave a comment