CPI slowed to 2.7% in November, with core inflation easing to 2.6%.

via CRE DAILY – click here for complete article

November’s inflation report came in cooler than expected, with core CPI rising just 2.6%—its slowest pace since early 2021. But behind the headline numbers, rent is playing a bigger role than most realize.

Rent Is the Hidden Hero in Slowing Inflation

Despite headlines cheering November’s cooler inflation, the real driver may be flying under the radar: rent.

CPI eases: Core inflation rose 2.6% in November, the slowest pace since early 2021, while overall CPI hit 2.7%. Despite shutdown-related data quirks, the surprise slowdown was driven by falling costs in hotels, recreation, and apparel—with shelter playing a major behind-the-scenes role.

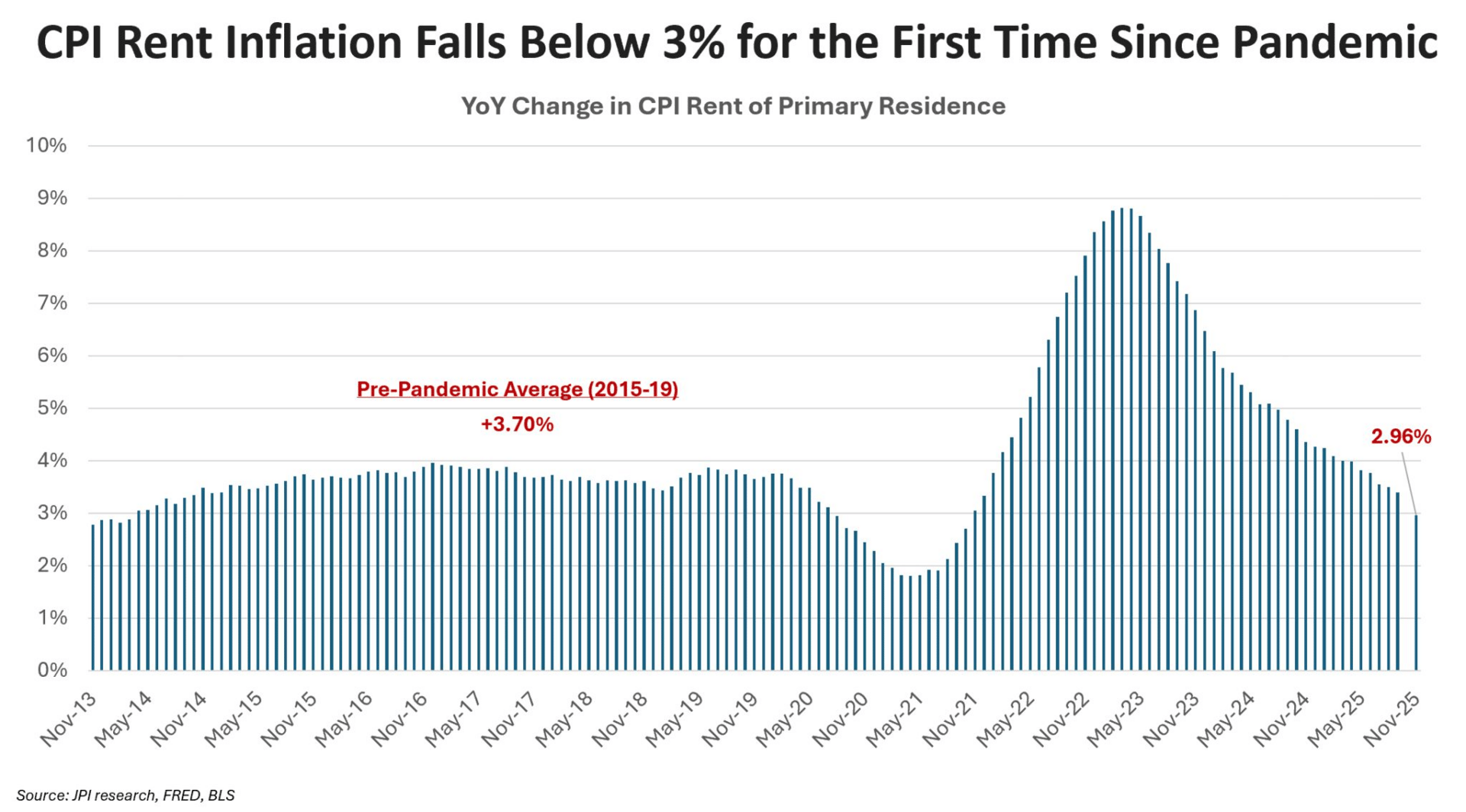

Shelter inflation cools sharply: Shelter costs rose just 3%—the weakest pace in over four years, according to Jay Parsons. With CPI rent data lagging real-time trends (now near 0% growth), housing inflation is likely to continue cooling well into 2026 or beyond.

Why rents are falling: A record apartment-building boom in 2023–2024 has flooded the market, pushing rents down, especially in the Sun Belt and urban cores. Even as new starts slow, ongoing lease-ups mean rent pressure will stay low for some time.

Mortgage and Fed outlook: Cooling inflation, especially in shelter, could nudge mortgage rates lower and boost odds of Fed cuts in early 2026—though officials remain cautious, awaiting more data.

➥ THE TAKEAWAY

Big picture: Rent is the anchor holding inflation down—and likely will be through 2027. For markets and the Fed, it’s the sleeper story shaping the 2026 outlook.

Leave a comment