ARLINGTON, Va. – 11 November 2025 – CoStar, the leading global provider of online real estate marketplaces, information and analytics, has released an updated forecast for the U.S. multifamily sector, reflecting a more cautious outlook for rent growth and vacancy trends through 2026.

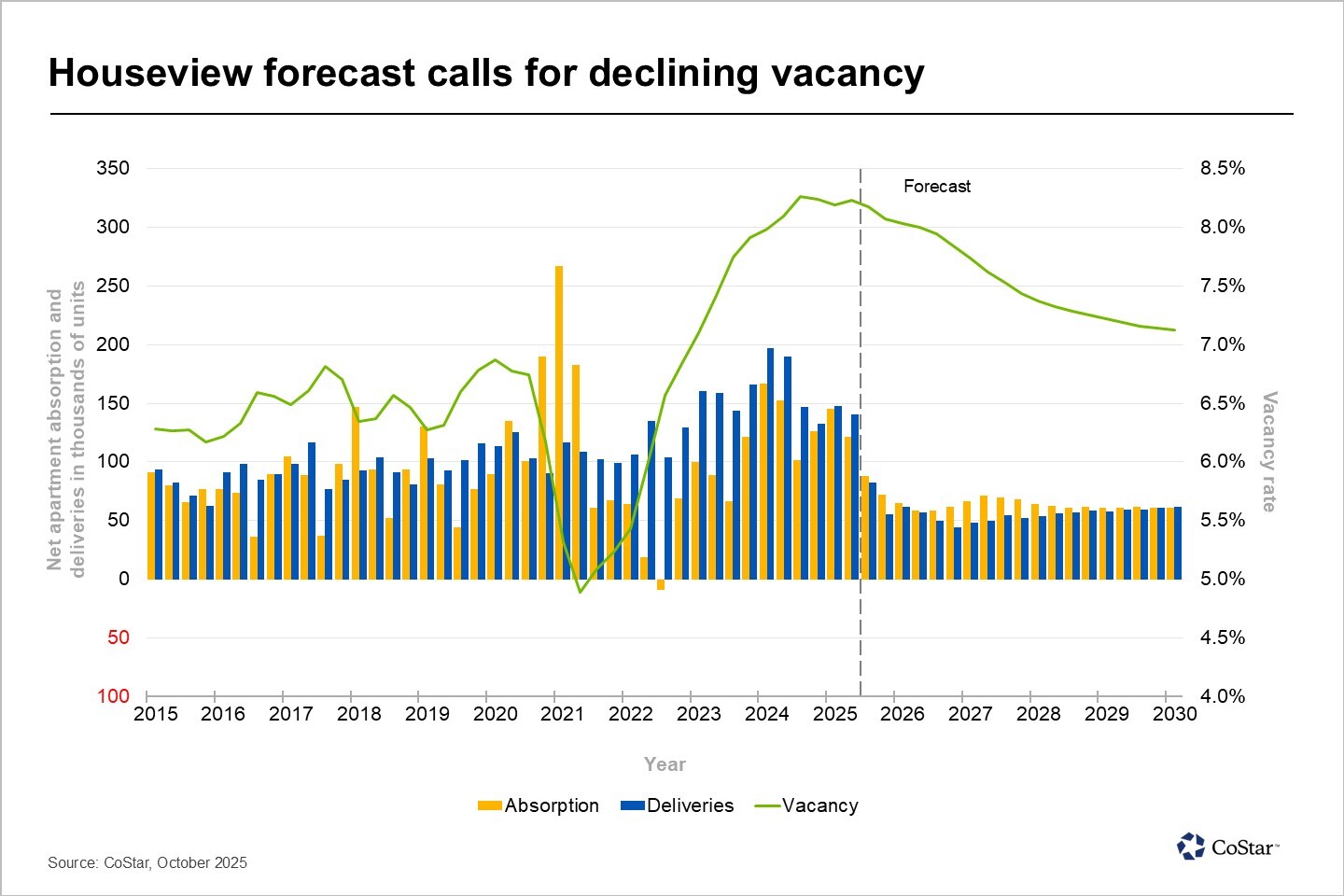

National apartment rent growth is now projected to decline by 0.1% in the fourth quarter of 2025, a downward revision of 160 basis points from the previous forecast. Vacancy is expected to hold at 8.2% through year-end before easing to 7.9% by the end of 2026.

“The revised forecast reflects a more measured view of near-term performance,” said Grant Montgomery, National Director of Multifamily Analytics at CoStar Group. “Still, a turning point is approaching. In the final quarter of 2025, renters are expected to occupy more units than are added to supply — a first since the third quarter of 2021. That shift should allow vacancy to begin receding in 2026, supported by a shrinking construction pipeline and steady renter demand.”

The updated outlook also accounts for slower growth in employment, population, and household formation, which may delay absorption in oversupplied markets. However, limited for-sale housing inventory continues to support multifamily demand by keeping many renters priced out of homeownership.

The full forecast can be found here.

Leave a comment