It’s NOT new lease-ups (though that’s no walk in the park, either) ~ Jay Parsons

Click here for complete article, research and others by Mr. Parsons

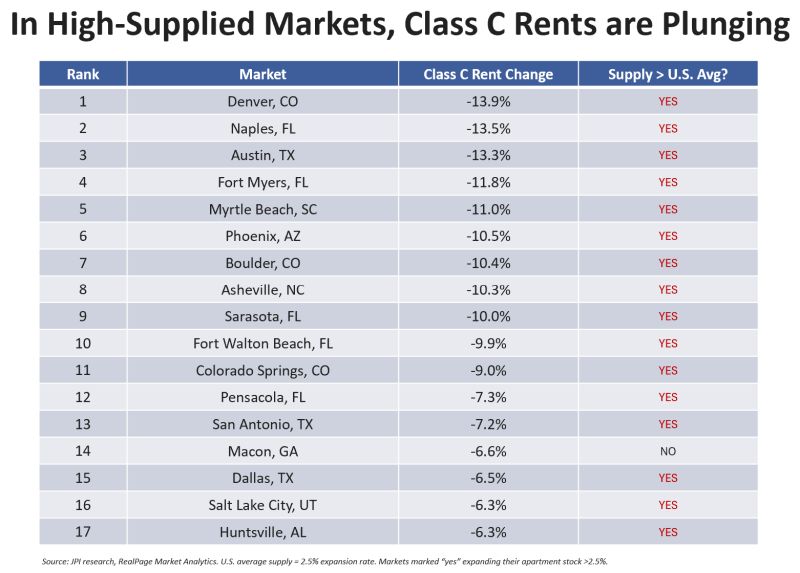

It’s at the lower end of the market — Class C — in the highest-supplied markets.

This is one of the most interesting storylines of the current cycle.

Class C apartment rents are getting absolutely crushed, but ONLY in high-supplied markets. There are 17 MSAs where Class C rents are down more than 6% and, in all but one of them, the new supply expansion rate tops the U.S. average.

Class C rents were down by double-digits in places like Denver, Austin, Southwest Florida, Phoenix, Myrtle Beach, among others.

On the flip side: Class C rents are still RISING in low-supplied markets. There are 20 MSAs where Class C rents increased >3% year-over-year through September. Guess what was the common denominator in 19 of the 20? You guessed it. New supply rates BELOW the U.S. average. (See chart posted in comments for full list of Class C rent gainers.)

What’s going on? It’s the concept academics call “filtering,” and it’s happening at hyper speed in this cycle thanks to the country’s largest supply wave in nearly a half century.

As new apartments get built, where do you think those renters come from? Not from thin air. Most are moving up from older apartments. Upper-income renters and concession chasers from Class B+ and A- properties move to the new lease-ups. In turn, those properties cut rents and pull in better-income renters from Class C/B- properties, and on down the line it goes.

Here’s the challenge for Class C operators: In Class C, renters typically spend a higher share of income on rent. (While rent is cheaper, renter incomes tend to be lower.) So to backfill vacant units, Class C operators often have to cut rents MORE to pull in renters who previously may not have qualified for market-rate units. (This can also create potential challenges in the rebound, too.)

If there’s a silver lining, it’s two things:

1) We’ve seen nearly 3 straight years of wage growth outpacing rent growth, and that’s widening the funnel for who can afford apartments.

2) It’s a clear sign the current rent softness is entirely (or at least >90%) about SUPPLY, not about demand-side weakness or affordability. The correlation is as clear as could be.

#rents #apartments #multifamily #Dreznin #Parsons #DPCRE #CRE #incomeproducing

Leave a comment