Another well researched and informative article from Jay Parsons <—Click here to see more of Jay’s work.

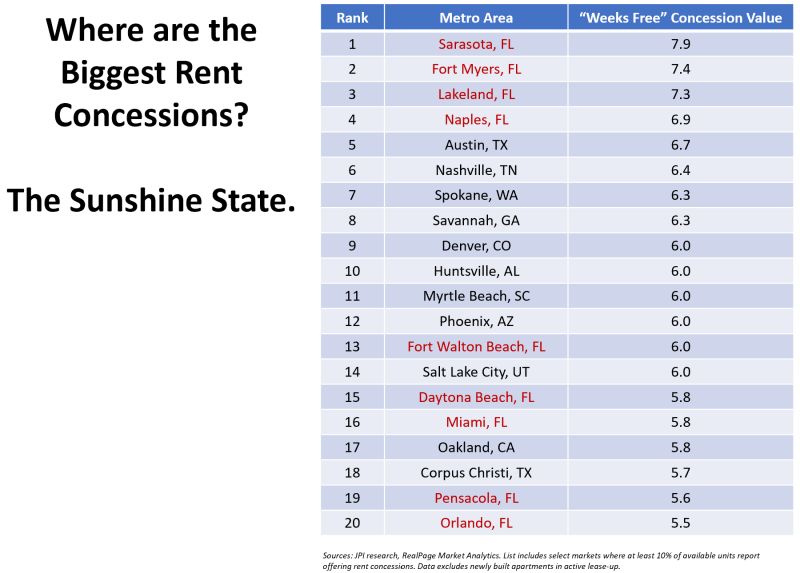

Here’s the top 20 markets with the most generous rent concessions right now. One state — Florida — claims nearly half the top 20 spots.

Nationally, concessions in stabilized apartments average about 5 weeks free right now — which is highest since the GFC era, and about 1 week above the typical discounts we saw during the pandemic period.

Concessions in stabilized apartments average nearly 8 weeks “free rent” in Sarasota and around 7 weeks in Fort Myers, Lakeland and Naples. Elsewhere, concession values reach 6+ weeks in ultra-high-supplied markets like Austin, Nashville, Denver, Phoenix and Salt Lake City.

Of course, the big difference between today and the GFC period is demand. There’s ample demand today at a macro level, yet muted leasing activity at the asset level in higher-supplied markets. That’s simply because demand is being spread across a far great number of properties, given new supply surging to nearly 50-year highs. So operators are competing for leases, and concessions are one tool in the toolbox.

The other difference today: With wage growth outpacing rent growth for 30+ months, today’s concessions are less about affordability and more about competition (particularly at the upper end of the market, where demand is concentrated). In other words, concessions probably aren’t stimulating much net new demand (although they could boost move-ups), but instead are helping property managers compete for a share of the demand.

Indeed, in all these spots like Florida with high concession usage, rent-to-income ratios tend to be low and macro absorption is still strong. But supply volumes are significant, creating heavy competition for leases.

Also: Reminder that concession values alone don’t tell the full story. Some markets and some operators may favor actual rent cuts over what amounts to a marketing gimmick. So this list isn’t a direct proxy for market softness.

Of course, concessions are most commonly leveraged among new apartments in lease-up, and in some markets, 2+ months free isn’t uncommon. That heavy discounting may convince some property managers even in stabilized properties to offer them as a marketing tactic instead of just cutting the rent to the equivalent level, particularly if they’re clinching to inflated views of going-rate rent.

Here’s a potential challenge, though: Leaning on concessions over actual rent cuts can create unrealistic renewal expectations. Concessions of 5-6 weeks amount to discounts of 10-12%. That means “burning off” concessions of that size equate to effective rent hikes of 10-12%. In many cases, that might be too much to burn off in one renewal…. plus some managers may be budgeting for market rent growth on top of that, which might be unrealistic. It also puts the renter in a potentially challenging spot.

Whether you get there through true rent cuts or concessions, the effective rent is what the rent actually is. And that’s the baseline for the renewal.

#rents #apartments #multifamily #cre #Dreznin #Parsons #dpcre #sarasota #fortmyers

If you would like to discuss our market(s), your properties, options for acquisitions, dispositions, refinancing, improvements to support a stronger bottom line, rent comps, a property valuation, vendor referrals, etc... Let’s connect!

Leave a comment