Rents fall as concessions become widespread and below data is pieced together from Costar Insights, CRE daily & Realpage.

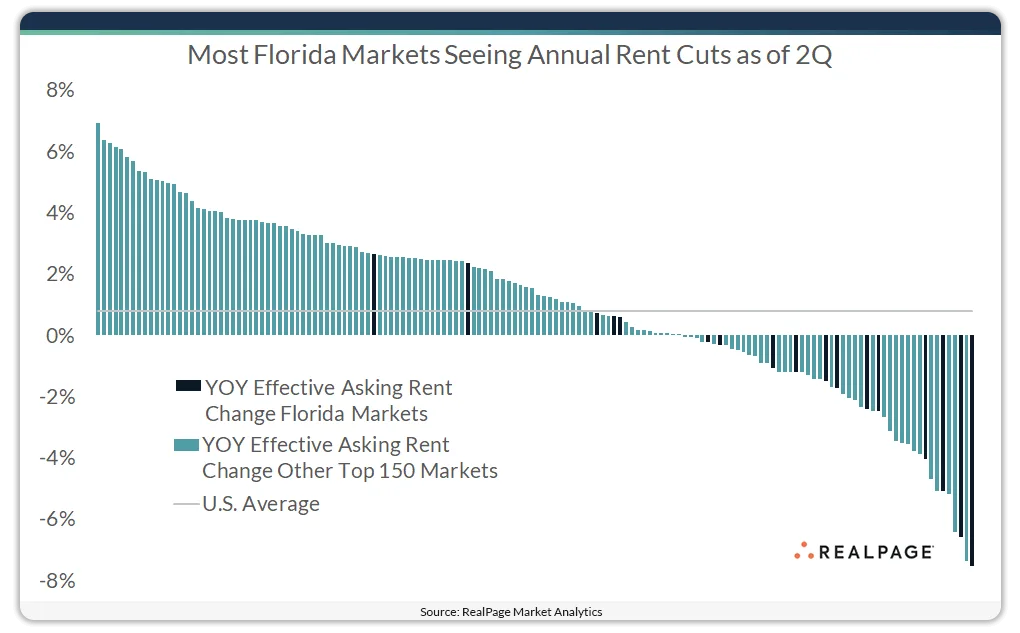

- Effective asking rents dropped 2%–8% across most Florida markets in the year ending Q2 2025, with Naples and Cape Coral seeing the steepest declines.

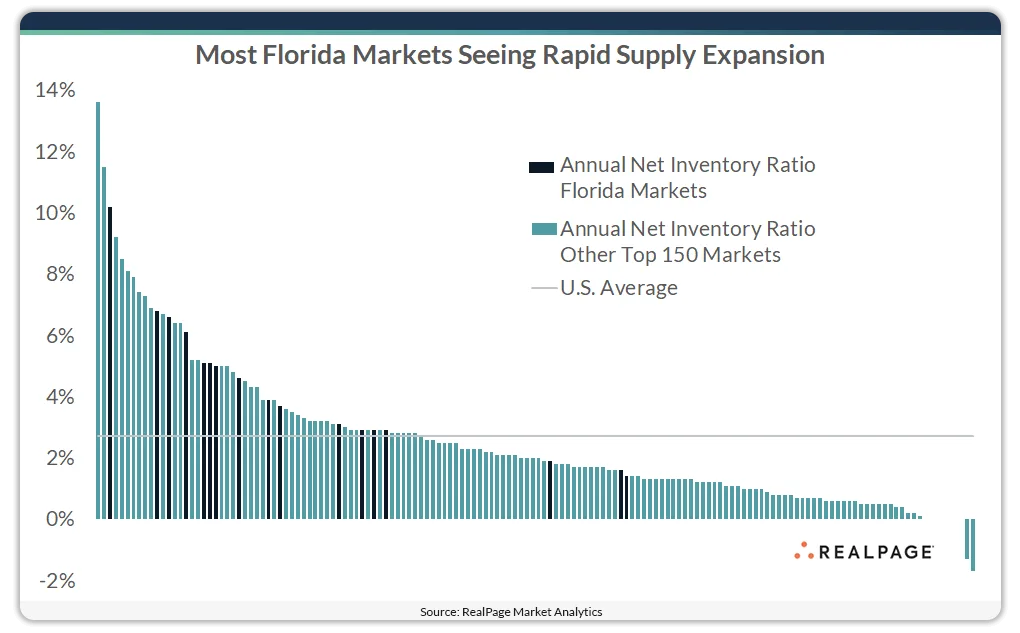

- The deepest rent cuts align with markets experiencing the largest supply increases, in some cases at two to four times the national pace.

- Only Tallahassee, Gainesville, and Port St. Lucie saw rent growth above the national average, driven in part by slower inventory expansion.

As reported by RealPage, Florida’s rental market is feeling the weight of a multi-year apartment building boom. With new units flooding the market and pandemic-era migration patterns leveling off, most metro areas are seeing rents trend downward.

Markets With the Largest Rent Declines

Naples posted a 7.5% annual decline in effective asking rents, while Cape Coral rents were down 6.6% year-over-year as of Q2 2025. Sarasota and North Port saw drops of 4%–5%, and larger markets like Jacksonville and Orlando experienced a softer 2.5% decline.

Moderate Declines and Limited Growth

In Lakeland, Deltona, West Palm Beach, Fort Lauderdale, Palm Bay, and Pensacola, rent cuts were less than 2%. Tampa, Gainesville, and Miami posted slight rent increases, though all remained below the US average of 0.8%. The outliers were Tallahassee (up 2.7%) and Port St. Lucie (up 4.1%), the only Florida markets beating national growth rates.

Supply Growth Driving Price Pressure

Inventory growth is a key factor. Only Tallahassee, Gainesville, and West Palm Beach saw new supply additions below the national average in the past year. By contrast, Cape Coral, North Port, Lakeland, and Jacksonville are adding apartments at two to four times the national growth rate of 2.7%, creating stiff competition for landlords.

Why This Matters

As Florida’s rapid construction pace continues to push vacancy rates higher, rent growth will likely stay muted. Markets with slower supply pipelines may hold pricing power, while high-build metros will remain under pressure.

What’s Next

Unless construction slows materially or demand accelerates, Florida’s rent softness is poised to persist, especially in markets with large project pipelines nearing completion.

If you are considering acquisitions in the Gulf Coast of Florida region or would like a valuation and analysis of your commercial income producing property(s), then let’s connect.

Leave a comment