By Jay Parsons •• Rental Housing Economist (Apartments, SFR), Speaker and Author

via LinkedIn <— Click here for complete article and other research perspectives by Jay.

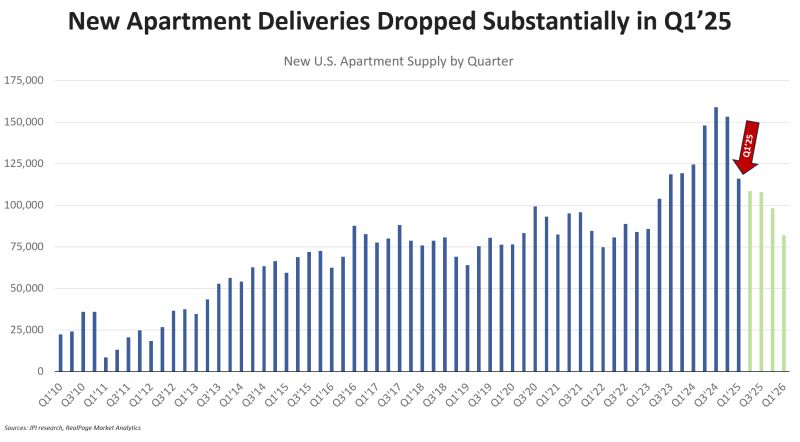

The historic peak in U.S. apartment supply is now in the rearview mirror. Completions dropped down to 113k units in Q1 2025 — still a hefty tally, but down substantially from the ~150k units delivered in each of the three preceding quarters.

To be clear: There’s still a lot of supply to work through this year, particularly over the next six months before completions (are scheduled to) plunge in the latter part of 2025. The full-year 2025 supply totals will remain above average in most U.S. markets (with some exceptions).

But given the massive decline in starts over the last couple years, the pipeline is rapidly thinning out, according to data from both RealPage and CoStar. That points to below-average supply in 2026. Perhaps even below 300k units, which would look more like the mid-2010s than the late 2010s. Furthermore, a bigger-than-usual share of that supply is likely to have workforce and/or affordable components, given that projects tied to subsidies or abatements are more likely to pencil out right now.

All that should play into the mainstream forecast of rents rebounding as supply drops off … assuming demand remains healthy. That’s not sure thing, particularly given increased fears of a recession tied to tariff wars. In that scenario, apartments (and SFR/BTR) are certainly not immune to a slowdown … but are still likely much better positioned than many alternative investment categories (including most CRE) given the fundamental need for housing, low unemployment, high barriers to purchase + favorable demographic trends.

What markets will see supply growth levels drop below their pre-pandemic averages first? It’s an eclectic list that includes pieces of every region of the country:

Midwest: Chicago, St. Louis, Milwaukee, Minneapolis

Sun Belt / Mountains: Houston, Dallas, San Antonio, Denver, Nashville (suburban faster than urban in that last one).

Northeast/Mid-Atlantic: Baltimore, Pittsburgh

West Coast: Bay Area, Portland

Some of those markets (particularly Midwest and Coasts) are already seeing rent growth levels topping 3% again. And most of the higher-supplied markets above are already showing signs of turning the corner and could be candidates for faster rebounds.

It’s all about supply and demand. Demand has been stronger-than-expected thus far. And while the demand outlook is increasingly murky, the supply side of the equation is known: Down, down, down … and it was headed that way long before tariffs were making headlines. Tariffs (potentially) only prolong the supply slowdown further.

For more details on the outlook, check out this week’s The Rent Roll podcast featuring special guest (and the pride of Youngstown, Ohio) Lee Everett — Cortland’s EVP and head of research. Lee is one of the great minds in multifamily research and always worth listening to.Activate to view larger image,

Leave a comment