via Crexi and numerous other sources (detailed with links at bottom of article)

Multifamily Trends

Analysis

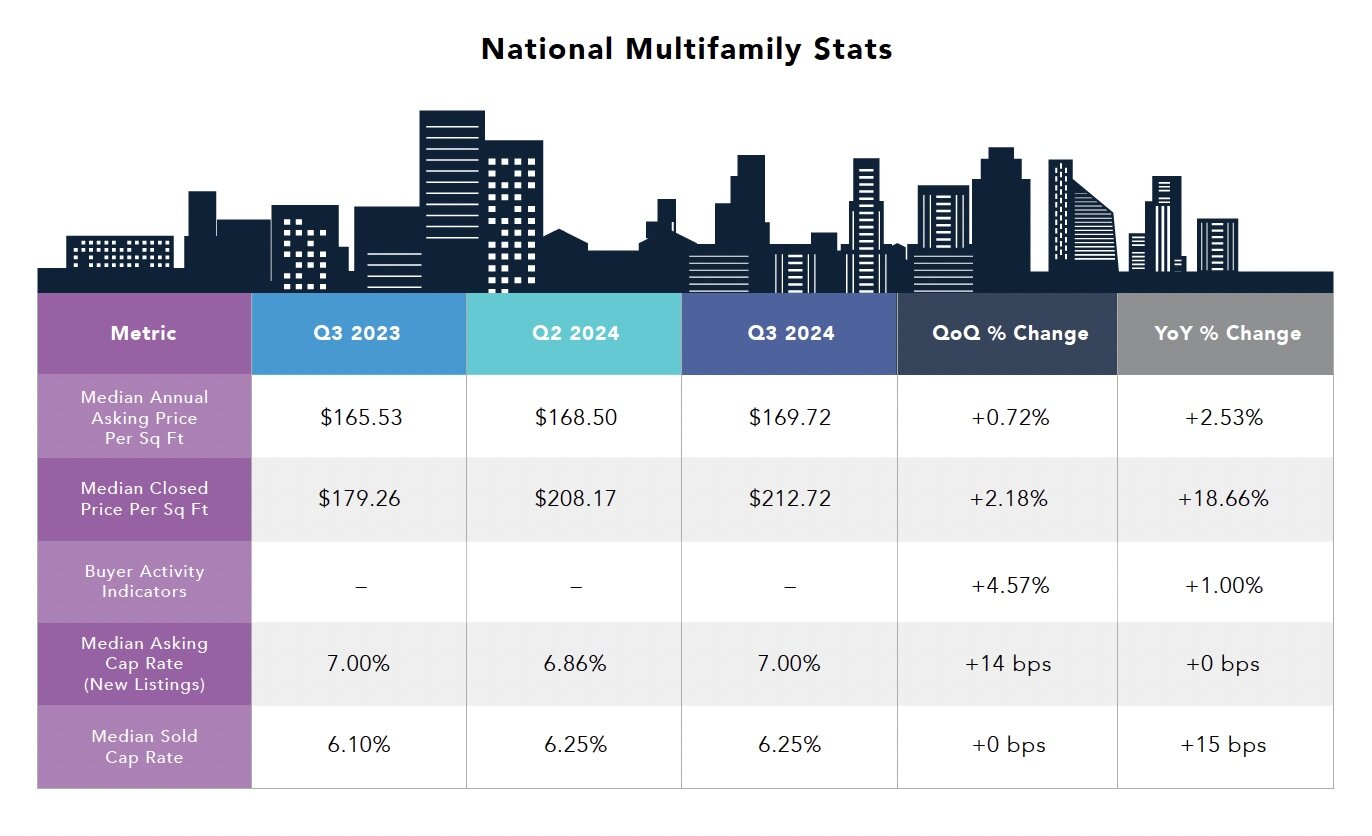

- Multifamily median annual asking prices per square foot remained relatively unchanged at around $170.00 QoQ, while the median closed price per square foot increased from $208.17 to $212.71. This suggests that strong buyer demand is pushing up sale prices, even as sellers maintain their pricing.

- Buyer activity indicators rose by 4.57%QoQ and 0.99% YoY, with continued demand expected to grow in the coming quarters as housing needs became a hot-button election issue. The steady interest also underscores the multifamily sector’s resilience, driven by sustained housing demand and demographic trends favoring rental living.

- Multifamily assets ranked second in search popularity on Crexi, with search activity up 10.46% from Q2 2024 and overall buy actions up 4.57% quarterly. This high level of interest suggests that investors are actively seeking opportunities in the multifamily market and engaging with sellers to close deals.

Final Thoughts

The third quarter of 2024 has been a transformative period for the commercial real estate industry. The Federal Reserve’s first interest rate cut in nearly two years, combined with a better-than-expected jobs report and cooling inflation, has injected renewed optimism into the market. While challenges like looming debt maturities persist, industry stakeholders are proactively developing creative solutions to navigate these hurdles.

With positive macroeconomic indicators and adaptive strategies, the CRE market is poised for a period of sustained growth and opportunity.

Metrics and Methodology

This article relies on data from Crexi’s marketplace. In particular, to ascertain timely and representative trends in seller sentiment, this article focuses on offering metrics, such as average asking price per square foot, cap rate, and monthly rents, in addition to listed occupancy, tenancy, and square footage. Using these listing-based metrics and changes therein, we can use seller expectations at the time of listing to approximate overall valuation trends.

While these data aggregations may broadly reflect prevailing market conditions, it is essential to note that variations can also be affected by inventory changes, asset size, etc. We pair these data points with internal data from Crexi buyers on search trends and acquisition-related actions performed on Crexi to provide a holistic understanding of where both sides of commercial real estate are headed.

Disclaimer

The information in this report is based on Crexi’s internal marketplace data and additional external sources that we consider reliable, but we do not represent it as accurate or complete.

Crexi internal marketplace data consists of aggregated property-level data points provided by brokers and reviewed internally by Crexi. While these data aggregations may largely reflect prevailing market conditions, variations can also be affected by inventory changes, asset size and other factors.

Nothing contained on this report or website is intended to be construed as investing advice. Any reference to an investment’s past or potential performance should not be construed as a recommendation or guarantee towards a specific outcome. The information, opinions, estimates and forecasts contained in this report are as of the date of the article and are subject to change without prior notification.

Download the full PDF below here.

1. https://www.federalreserve.gov/newsevents/pressreleases/monetary20240918a.htm

3. https://www.cnn.com/2024/09/18/economy/interest-rate-cut-decision/index.html

4. https://cre.moodysanalytics.com/insights/cre-news/the-first-rate-cut-is-here-now-what/

5. https://www.bls.gov/news.release/empsit.nr0.htm

7. http://www.investopedia.com/will-fed-rate-cuts-save-commercial-real-estate-cre-loans-banks-8719181

8. https://cre.moodysanalytics.com/insights/cre-trends/q3-2024-preliminary-trend-announcement/

9. https://cmbs.informz.net/cmbs/data/images/CREFC%203Q24%20BOG%20Survey%20Results.pdf

10. https://www.trepp.com/trepptalk/mbs-delinquency-rate-jumps-in-september-2024

11. https://urbanland.uli.org/capital-markets-and-finance/commercial-real-estates-wall-of-maturities

12. https://www.cbre.com/insights/briefs/some-distress-will-emerge-amid-wall-of-loan-maturities

14. https://preqin.com/insights/research/reports/investor-outlook-h2-2024

Leave a comment