Thousands of Units Have Been Completed in Past Year

By Michelle Rumore

CoStar Analytics

May 22, 2024 | 12:41 P.M.

The Tampa multifamily market has seen a flurry of development over the past few years as developers have looked to tap into the region’s population growth. Over the past three years, roughly 25,000 units have been completed, the bulk of which are higher-end 4- and 5-star properties.

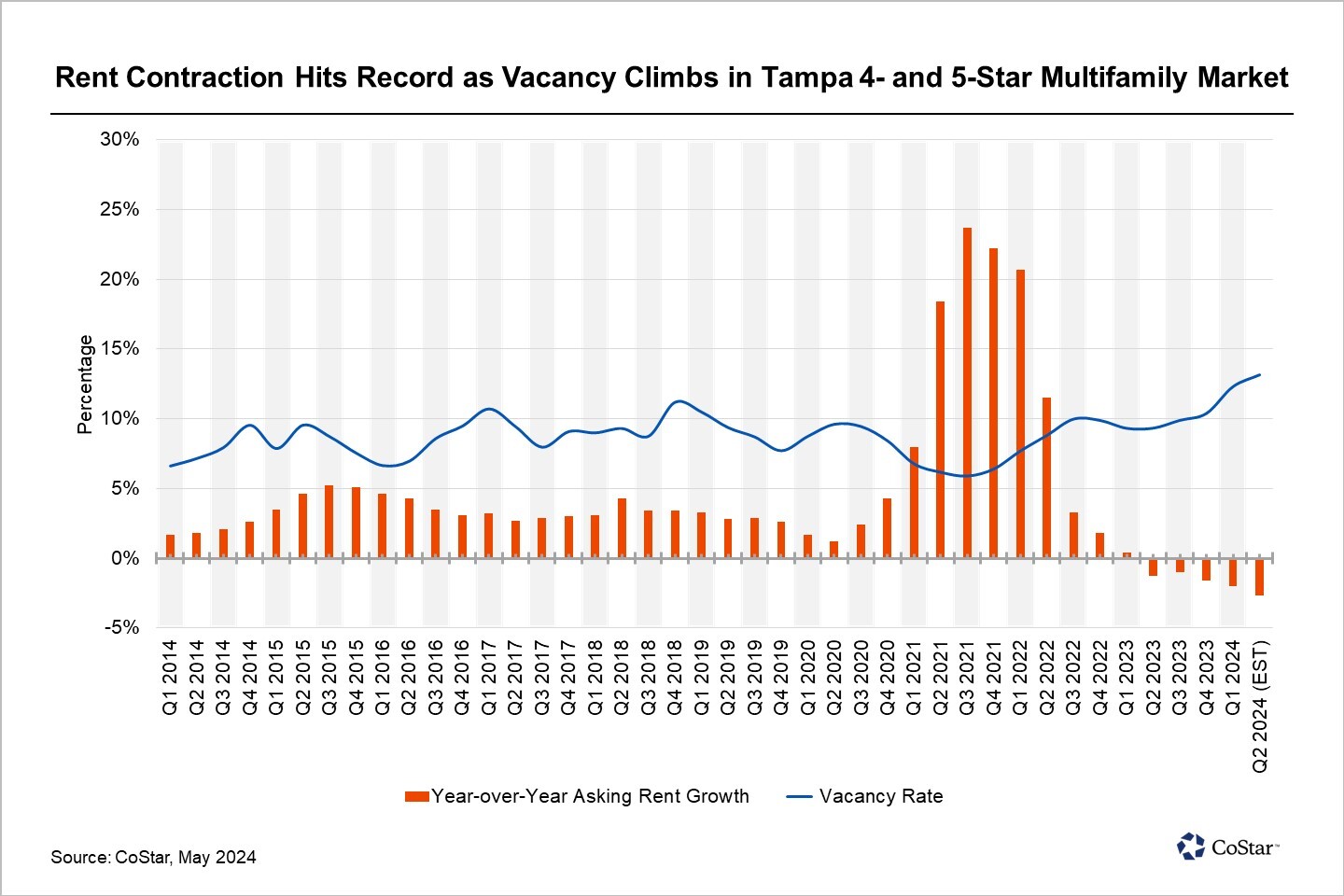

As a direct consequence of this new supply, the overall market’s vacancy rate reached a 15-year high at the close of the first quarter of 2024, just under 10%. Since then, the market’s vacancy rate has stabilized, averaging 9.7% as of May. However, the region’s 4- and 5-star vacancy rate has continued to climb and is expected to end the second quarter at 13%, an all-time high.

Despite posting trailing 12-month net absorption of 3,900 units over the past year, Tampa’s 4- and 5-star vacancy rate has increased by 300 basis points from this time last year, as 7,400 units were completed over the same period. Absorption is the change in the number of units occupied.

Although the 4- and 5-star quality subset has recorded several quarters of positive absorption, the rate of completions far outpaced renter demand, causing vacancies to rise. This trend is forecast to continue over the coming quarters as the high-end pipeline of 10,000 units is set to be completed.

The surge of new units has dramatically increased the competition for renters, and as such, landlords have shifted their pricing lower and are increasingly offering concessions. Over the past year, asking rents for 4- and 5-star properties have decreased by 2%. Effective rents, which also factor in concessions, have declined by 3%. In comparison, the U.S. average asking rents for 4- and 5-star properties have stabilized, changing 0.2% year over year.

... For complete article and others by Michelle Rumore, CLICK HERE <—-

4- and 5-star properties completed over the past two years have some of the highest concession rates in the region. For example, RISE Sereno completed construction in the first quarter of this year. The 320-unit property has already decreased its asking rent by roughly 11% from its pre-completion pricing and is offering up to eight weeks of free rent concession.

Market participants have indicated that concessions are more of a way of getting potential renters in the door. Renters are shopping for apartments more than ever before, in large part due to the increased offerings at each price point. The current vacancy rate of properties with an average asking rent between $1,900 and $2,200 per month is 17% compared to 7% at the end of 2021, which equates to 3,300 more units for renters in that price range to choose from.

Tampa’s asking rent growth outlook is bleak through the remainder of the year. The additional 14,000 units that are set to deliver, 10,000 of which are in 4- and 5-star properties, will likely keep Tampa’s vacancy rate elevated and, in turn, limit landlords’ ability to push rates. The pendulum is forecast to shift back in favor of landlords by mid-2025 but at a forecasted 2.5%, future annualized rent growth will likely be well below the 10-year average growth rate of 5% for years to come.

If you would like to discuss this article or other market news, let’s connect.

Sean Dreznin

Dreznin Pappas Commercial Real Estate LLC

Leave a comment