It’s always nice to see my current and hometown of Sarasota, FL on the list!

– Jay Parson’s (Realpage) follow up to ‘Which (larger) markets grew at fastest rates’ <–Click on Jay’s name to visit this full article and heaps of juicy research!

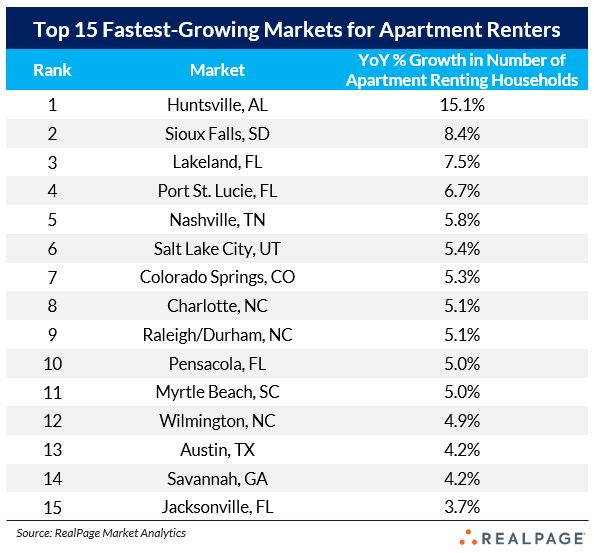

Yesterday I shared the top U.S. markets for apartment demand in 2023. But since those types of leaderboards favor large markets, I wanted to follow up by sharing the size-adjusted version of the demand leaderboard: Which markets grew at the fastest rate in 2023? This version highlights the growth rate in the number of households renting apartments. Here are the top 15.

— Huntsville, AL, is in a category of its own with 15.1% more apartment renting households in 2023 versus 2022. Huntsville is no secret among apartment developers (as Huntsville also led the nation in supply growth rate for 2023), but it still flies below the national radar despite a well-balanced economy headlined by a boom in high-paying aerospace jobs.

— A trio of booming tertiary markets rank next: Sioux Falls, SD; Lakeland/Winter Haven, FL; and Port St. Lucie/Vero Beach, FL. All three benefited from pandemic-era migration booms, and while growth is moderating (as expected), these three appear to have staying power with different appeal in all three.

— But it’s not all about small markets. Bigger metros cracking the top 15 include Nashville, Salt Lake City, Charlotte, Raleigh/Durham, Austin and Jacksonville. Remember the bigger you are, the harder it is to grow at a fast rate, so growth rates of 4-6% are absolutely remarkable for this group. Analysts often bemoan the huge supply hitting all these markets, but let’s not forget what is driving all that supply: A LOT of demand. And while demand likely can’t keep pace in the short term, there’s little doubt demand will remain robust in these spots even once supply drops off in 2025-26. Cynics will say “but growth is slowing,” but that slowing is off the all-time highs of 2021. “Slowing” to pre-COVID levels in these markets still equates to huge growth.

— Others to highlight: Colorado Springs, CO; Pensacola, FL; Myrtle Beach, SC, Wilmington, NC; and Savannah, GA. And ranking right behind them are Sarasota, FL and Boise, ID. Takeaway: People like the beaches and the mountains. Some folks dismiss markets like these as “Zoom towns” that temporarily boomed only to bust. But they forget these were growing markets even prior to COVID. These aren’t merely seasonal spring break cities like some others. Moderating growth was inevitable, but these spots will remain migration magnets. Of course, smaller markets tend to be more prone to boom/bust cycles and most of these do have a lot of supply in the short term to work through, but they should do well over the longer term.

Supply shocks can cause short-term challenges. But over the long term? Follow the people.

#apartments #multifamily #rentersActivate to view larger image,

Leave a comment