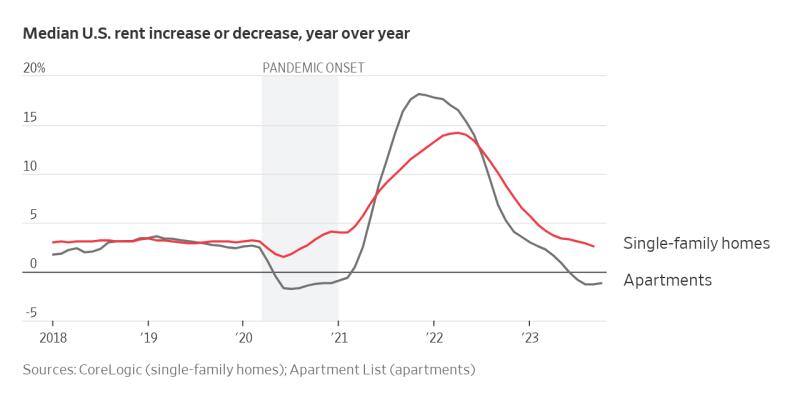

Single-family rentals are outperforming multifamily this year due to lesser supply, BUT … even SFR isn’t immune to slowing rent growth. This is further confirmation of what we’ve said for a year: Higher mortgage rates do NOT drive up net new rental demand or rent growth.

Every rental operator should cheer for a stronger for-sale housing market. Historically, the top years for rental demand and rent growth came amidst a hot housing market. Just look at 2021 and the mid-2000s (pre-GFC) as examples.

The big difference between SFR and apartments right now is supply. It’s all about supply.

In multifamily, apartment construction hit 50-year highs and deliveries are peaking now through 2024. Apartment demand remains very solid, but closer to “normal.” Not blazing hot re-acceleration to 2021 levels. And not enough to keep pace with supply. So rent growth has flattened out, and has gone negative across much of the West Coast and the Sun Belt where supply is heaviest.

In single-family rentals, supply is increasing but not nearly to the same degree as multifamily. So rent growth is normalizing, but not disappearing. We’ve seen owners with flexibility choosing to rent out homes rather than sell them (the “accidental landlords”). We’ve seen big increases in build-to-rent single-family (BTR) in certain submarkets (but not universally) giving renters more options. And we’ve seen some conversions of short-term rentals into longer-term rentals (but let’s not exaggerate this one as some like to do).

The tone of media coverage and even some industry chatter today is that high mortgage rates are driving massive demand into rentals. But this take fundamentally misunderstands how housing demand works. It’s not an assembly line of newly formed households sending some to homeownership and some to rentals. Household formation is cyclical, too, and low consumer confidence plus inflation has slowed down household formation. So while renters may be renting longer, we aren’t adding nearly as many net new renters as we did in 2021.

That’s a big reason rent growth has cooled off in multifamily and normalized in SFR. For the near term, barring a big shock, we’d expect continued solid-but-unspectacular rent growth for SFR and flat-ish rents in multifamily. By 2025-26, apartments could outpace SFR again as supply levels are scheduled to plunge dramatically.

Longer term, if home prices and mortgage rates remain elevated while supply remains fairly stagnant, that could put gradual upward pressure on rent growth. And if policymakers decide to further favor wealthier homebuyers over renters by limiting investor purchases of single-family homes, that will obviously drive up SFR rents in those areas.

But if/when the for-sale housing market heats up again, look for rentals to heat up again as well — as they always have in the past.

Jay Parsons is a Rental Housing Economist (Apartments, SFR), Speaker and Author

Talks about #sfr, #housing, #apartments, #realestate, and #multifamilyTalks about hashtag sfr, hashtag housing, hashtag apartments, hashtag realestate, and hashtag multifamily

RealPage, Inc.

Leave a comment