By: Apartment List Research Team

Click here for full report <—-

Below find portions of the report for reference.

Overview

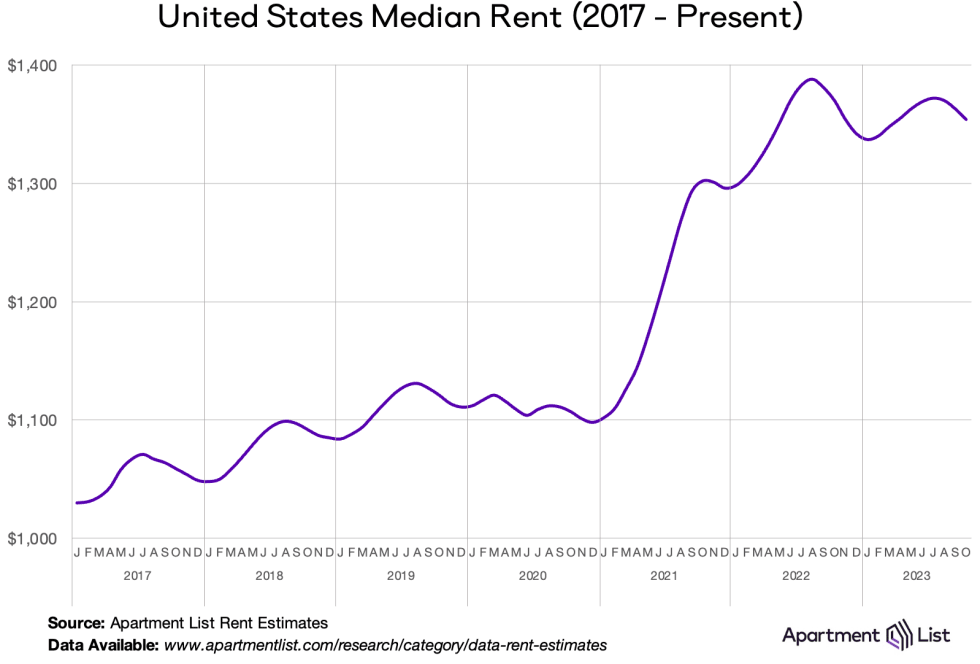

Welcome to the November 2023 Apartment List National Rent Report. The seasonal slowdown in the rental market continued this month, with the nationwide median rent falling by 0.7 percent to $1,354. This marks the third consecutive month of negative rent growth, and declines are likely to persist in the coming months as we head into the winter.

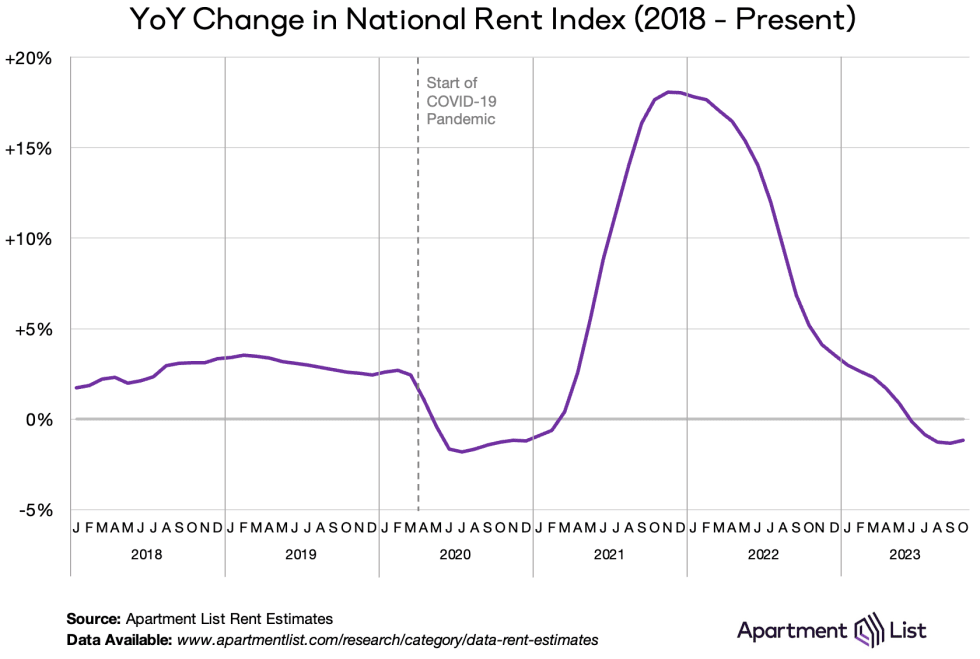

Year-over-year rent growth remains in negative territory at -1.2 percent, meaning that on average, apartments across the country are slightly cheaper today than they were one year ago. This stands in sharp contrast to the prevailing conditions of 2021 and 2022, when rent prices were surging and year-over-year growth peaked at 18 percent nationally. But despite the cooldown of the past year, the national median rent is still nearly $250 per month more expensive than it was just three years ago.

On the supply side of the market, our national vacancy index currently stands at 6.4 percent, slightly higher than the pre-pandemic average. This represents the culmination of vacancies gradually easing for two full years after a historic tightening in 2021. And with the construction pipeline of new apartments still near record levels, we expect that there will continue to be an abundance of vacant units on the market in the year ahead.

Regionally, rents fell in October in 81 of the nation’s 100 largest cities, and prices are down year-over-year in 66 of these 100 cities. The sharpest rent declines over the past year have been in Oakland (-8.2 percent) as demand in the Bay Area remains sluggish, and Austin (-6.4 percent) as an influx of new supply has begun to impact prices.

Rents are down 0.7% month-over-month, down 1.2% year-over-year

Rent growth follows a seasonal pattern – rent increases generally take place during the spring and summer, whereas the fall and winter usually see a modest price dip. This year, the slow season started a month earlier than usual, with a slight 0.1 percent decline in rents in August. Those monthly declines have gotten progressively steeper in the months since, with rents nationally falling by 0.5 percent in September and 0.7 percent in October.

This is the second steepest October rent decline that we’ve seen in the history of our index (going back to 2017). The only time that October brought a sharper decline was last year, when rents fell by 0.8 percent as the market shifted into the period of sluggishness that still persists. For comparison, from 2017 to 2020, October declines ranged from -0.4 to -0.6 percent.

On a year-over-year basis, rents nationally are down 1.2 percent. Year-over-year rent growth fell to zero in June for the first time since the disruption of the early stages of the pandemic, and has now been in negative territory for four consecutive months. Seasonal trends suggest that monthly rents will continue to dip for the remainder of the year, but if these declines are more modest than those of last winter, year-over-year growth could rebound. In fact, it appears that year-over-year rent growth may have already hit its bottom, having ticked up slightly from -1.3 percent last month to -1.2 percent this month.

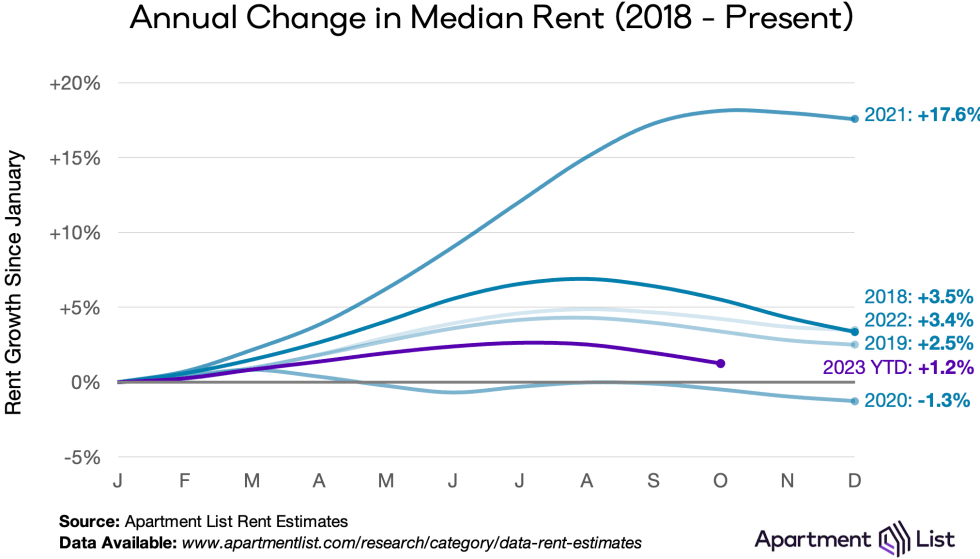

Year-to-date, rents are up 1.2 percent and trending slower than every previous year measured by our index, aside from 2020. Setting aside the rapid inflation period of 2021 to 2022, rent growth from January through October averaged 3.5 percent during the steady-state years of 2017 to 2019, nearly triple the increase we’ve seen this year. Rent growth has not just cooled from recent peaks, but is low even compared to the modest growth of pre-pandemic years, as prices are being kept in check by sluggish demand colliding with a robust supply of new inventory hitting the market.

Leave a comment