Think back in the day, like a kid on Saturday morning waiting for their favorite show to come on the regularly scheduled programming, I never tire of Jay Parsons posts, comments and deeply researched inferences.

Here is another one with links to other well respected folks in our arenas.

What’s the relationship between cap rates and interest rates? This is one of those hot topics in real estate that always generates passionate viewpoints on both sides. I’m in the camp of the great Peter Linneman on this one, who has argued that cap rates are not directly correlated with interest rates, but with capital flows.

In fact, Peter wrote a paper with Matt Larriva, CFA pointing out that the correlation between cap rates and interest rates is the “same level of correlation that exists between pool drownings and Nicholas Cage films.” 🤣 Linneman and Larriva’s paper goes into much more depth than I can cover here, so let me make a few simple arguments:

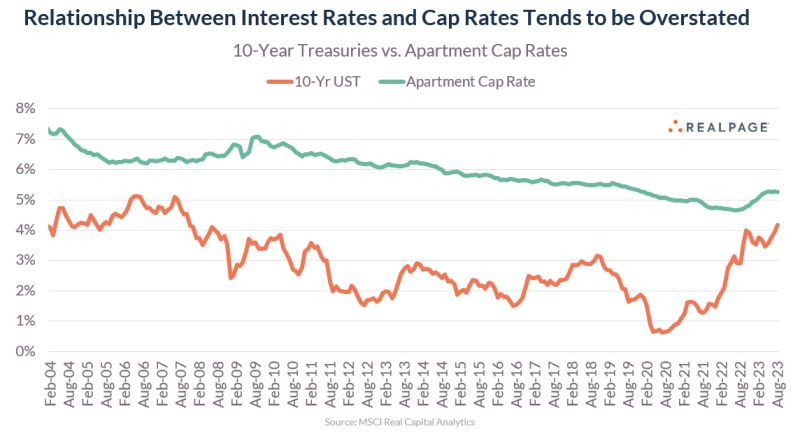

— Between 2004 and 2021, multifamily cap rates showed almost no responsiveness to (relatively minor) shifts in the 10-year Treasuries.

— As the Fed started hiking rates in 2022, multifamily cap rates have risen moderately … but not nearly as much as interest rates. Not even close.

— One simple way to view this is that, based on Linneman’s research showing cap rates are primarily responsive to capital flows, we know capital flows have obviously been impacted by higher interest rates. The sheer size and speed of the rate hikes ensured that. Nearly every type of investment (including outside of real estate) will be impacted to varying degrees.

— So therefore, you could argue that cap rates are “sensitive to” large swings in interest rates, but “correlated with” is a much stronger and inaccurate description.

— Another factor to consider is that multifamily has grown substantially in favor with investors over the last few decades, maturing from an alternative (perceived high-risk) asset class to a rather mainstream one. A more attractive profile attracted more capital, and a result, yields relative to treasuries have compressed over time… and investors have accepted that.

To be clear: Obviously investors want to see interest rates tick back down; and when they do, more capital will re-enter the market and that will likely push cap rates down again.

But if you’re 100% convinced that cap rates are correlated with interest rates, then you’re waiting for cap rates to rise another 3 full percentage points (to a >8% cap) to catch up with treasuries. And if so, you’re probably gonna be left standing on the sidelines.

#CRE #capitalmarkets #multifamilyrealestateActivate to view larger image,

Leave a comment