Welcome back to Premium to Principal! After the welcome edition, we wanted to hit the ground running with a behind-the-scenes look at the state of the property insurance market, with a focus on multifamily properties, and how we got to the place we are at now – which is the hardest (see below – hard market defined) property insurance market that we have experienced in the past 40 years – and most importantly, what you can do to adapt and overcome as we move forward. Buckle up, we have much ground to cover, and my goal is for you to walk away understanding the current marketplace, which will lay a foundation for the December Edition of this newsletter where we will cover all of the actionable steps and strategies you can use to leverage insurance to your benefit and get the most competitive premiums!

The Insurance Risk Management Institute (IRMI) defines a hard market as an “upswing in a market cycle when premiums increase and capacity (the supply of insurance available to meet demand) for most types of insurance decreases.” That means insurance is more expensive and harder to obtain.

WARNING – this will be a long read, but we wanted to give you the tools to understand the multifamily and property insurance marketplace and make informed decisions for yourself – just in case the guidance you have received for the past few of your renewals has been “It’s bad out there! Rates are up!”… The next edition can be an easy iPhone read in between meetings, but this one is worth the read.

Why is the market so challenged, and why do premiums continue to rise?

This is the number one question that we hear every day while helping our clients, and the question that many of you have likely been asking for a very long time – where is this coming from, and where will it end? The answer is that six core issues affect the property insurance marketplace as a whole at a national level, which are the drivers for the turbulence (in some cases mayhem) that we are seeing, with other ancillary issues often at play in more local and regional settings (state by state, places such as CA, TX, FL, etc.).

These issues in order of severity are:

1. Severe Shortage of Reinsurance Capital

2. Increased Frequency and Severity of Claims and Losses

3. Rates and Profitability

4. Insurance to Value

5. Replacement Costs

6. Material and Labor Shortages and Costs

While these are the most tangible factors behind the challenged marketplace, there are other factors at play too – such as underwriter workload being at an all-time high, marketing submissions (agents seeking new coverage) occurring at an overwhelming rate (5X as much active shopping among carriers as 5 years ago), and other logistical and operational dynamics occurring behind the scenes as well.

We find that most owners/operators/property managers who have proper guidance around the present marketplace, and access to the right agent/broker representation with the proper strategies and relationships, can still make the right decisions that reduce the impact of the current market and will allow those groups to survive this market, and in some cases, even thrive and outcompete others on new deals and opportunities that others consider out of reach.

Reinsurance Capital Shortages

Reinsurance is a behind-the-scenes piece of primary insurance that most people do not even know exists, and those who do may not have an in-depth working knowledge of the function. Reinsurance exists so that primary carriers (the carriers you buy insurance from – think Travelers and Liberty Mutual) can offload a portion of their risk on the insurance that you purchase from their balance sheets, by way of reinsurance, onto someone else’s balance sheet, the reinsurance carrier. This is insurance for the insurance company so that when losses meet or exceed a certain threshold, they can tap into this insurance and thus are not forced to solely pay the totality of a claim. The availability of reinsurance is crucial to the capacity (total amount of insurance that a carrier can offer to the marketplace) and cost of the insurance that property owners and operators purchase, and in the past 18 months, there has been a $60B+ gap in the needed reinsurance and the available reinsurance in the marketplace, causing a severe shortage.

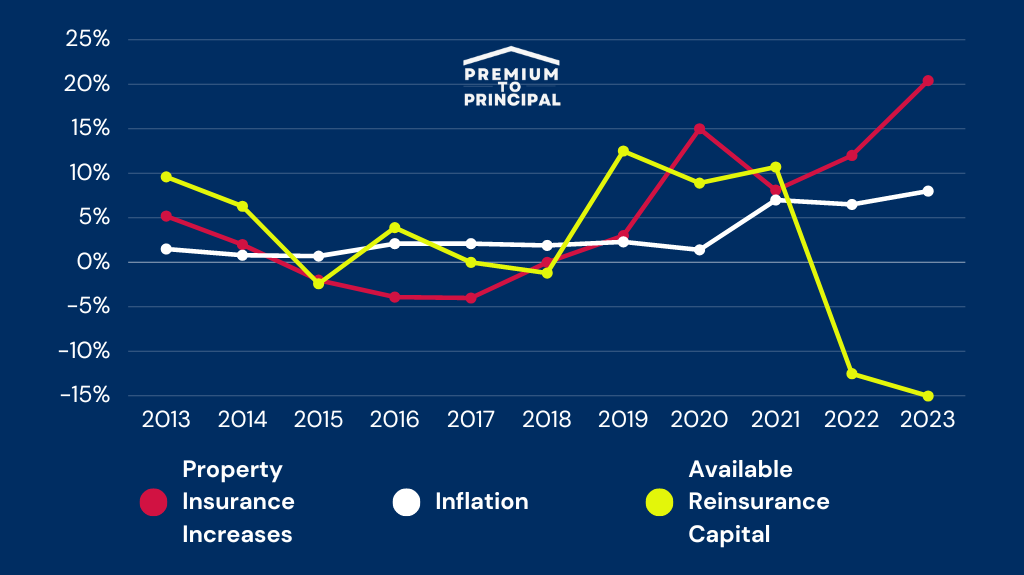

Now onto the real question – why is there a shortage of reinsurance capital available in the marketplace? This one has a simple answer, and a relatable story for all of those who invest in real estate that I like to use to explain it. Let’s say you invested in a property, and for 10 years you lost money EVERY YEAR – capital calls, missed distributions, frantic investors and lenders – you get the point. While grossly oversimplified, this is exactly what has happened in the reinsurance markets for the past decade – every year for the past 10 years, they lost money and eventually had enough and took their investment capital to other industries where they could generate a return – this is quite dramatically highlighted in the above graphic where you can pinpoint where reinsurance capital was withdrawn from the marketplace.

The fix – there is light at the end of the tunnel with January 1, 2024 reinsurance renewals projected to be substantially easier/better than they have been for the previous two beginning-of-year renewals for the reinsurance contracts. While a flat renewal is not anticipated, a scenario where we experience minimal increases and an uptick in reinsurance capital should still bring back capacity and stability to the rates.

Claims and Losses

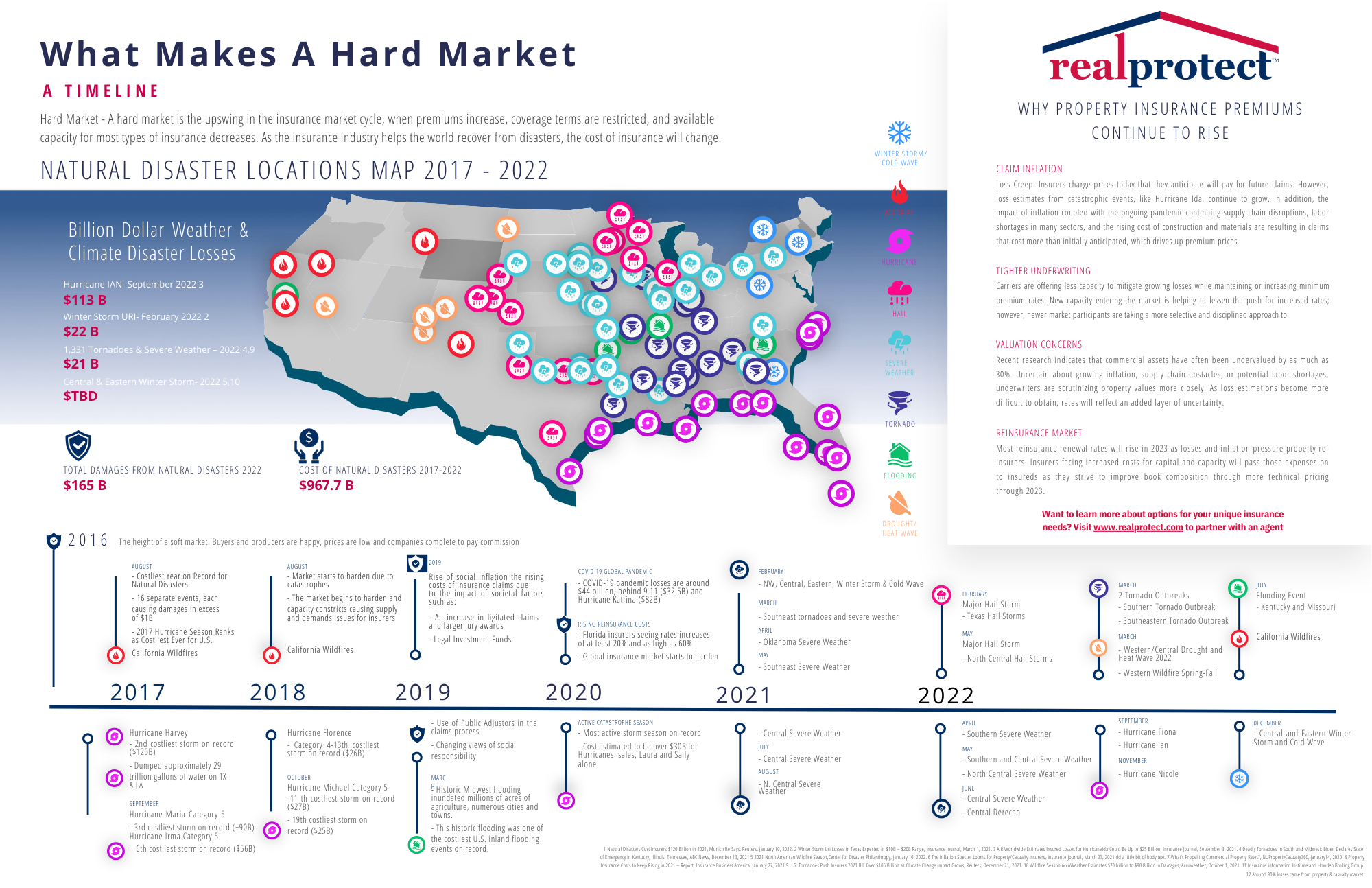

This is perhaps one of the more straightforward issues we are facing – across the nation, there are twice as many claims occurring, and the severity (amount paid) of these claims is twice as much as it was 10 years ago. To narrow this down to the scope of Catastrophe Losses (these are Hurricanes, Floods, Wildfires, Tornadoes, and Winter Storms – and now, Severe Thunderstorms), just these types of claims have surpassed annual payouts north of $100B EACH YEAR, for five of the past six years. Last year alone (2022), total Catastrophe losses were north of $140B. Up to the midpoint of 2023, these natural catastrophes surpassed $50B in claims, and we are projected to top $100B by end of year for the now sixth time since 2017. If you recall from earlier, we discussed reinsurance losses that were ceaseless for the previous 10 years – this is, as I am sure you have already caught on, the reason why. A final point to touch on related to this is that certain states, let’s pick on Florida for a moment, are large drivers of insurance fraud, which is often seen as a victimless crime but has brought the Florida insurance market to a breaking point – so much so that the Florida Insurance Department has made over 100 hires since 2022 in its fraud investigation division alone, where they actively investigate these occurrences of potential and actual fraud.

Another subpoint that goes hand in hand with these issues is the rates and profitability of the carriers. Now, I’m not here to cry “poor insurance carrier”, and ask you to double the size of the check you send them monthly/annually, but more so to explain the necessity of carrier profitability, and just like all things in the free market, how carrier/company profitability increases capacity and availability of insurance while driving down the prices. Point being – as carriers are able to address these issues head-on, and course-correct, the more stability we will begin to see.

The fix – while we cannot change the seemingly sudden uptick in issues that are affecting the nation as a whole, not just coastal areas as they once did, insurance carriers are doubling down on technology to help better predict, and therefore better price insurance coverage.

Insurance to Value, Replacement Cost, and Material/Labor Shortages and Costs

These issues share a tremendous amount of commonality as well, so for time’s sake, let’s tackle them together as well. Just like how interest rates and inflation are on the rise, we are seeing a very similar thing with these issues.

Replacement Cost, which many of you are likely familiar with, refers to the cost associated with replacing a building, either partially or completely, if it were to experience a claim. This cost is often broken down into a $/SQ/FT figure that is a bit easier to wrap your arms around. This seems fairly straightforward right? Not always. The issue is that you select a replacement cost for your property at the time you purchase insurance, but it is not until the time of the claim that you know if you have the right amount of insurance or not – a large part of this is due to material and labor issues around availability and cost. To cite a few examples, structural steel has increased 55%, lumber 35%, machinery and equipment costs are up 18%, and wages for labor are up 16% – all within the past three years. This leads to an approximate jump of 32% in replacement costs for multifamily properties. This means (in theory) a multifamily/apartment complex that had a rebuild/replacement cost of $20MM three years ago should carry AT LEAST$26.5MM in coverage to be even in the right ballpark for carrying the right amount of coverage. Since the premiums that you pay are determined by the carrier-set rates, multiplied by the value of what you are insuring (for most multifamily operators, this is structure replacement cost plus the property rents), the increase in just this metric alone can have a substantial impact on the premiums you pay.

Lastly, carriers are now taking an active role in making sure that these replacement cost figures are at least falling within general updated guidelines that they have set, i.e. they are not using the same replacement cost as when the policies were purchased originally five, ten, or even 10+ years ago. This is expressed by the phrase “insurance to value”, effectively the amount of insurance that you carry vs. the amount of replacement cost that a property would bear. These are still just general guidelines, and you should always take care when insuring your properties and making sure that you are purchasing (to the best of your ability) an amount of coverage that suits your property. Some of the adjustments being seen right now in replacement cost increases represent changes that should have been made incrementally over the past 3, 5, 10 years that did not occur.

The fix – while experiencing a carrier rate increase, alongside an increase in the values you now have to carry for replacement cost, this almost comes across like a double-rate increase – being hit from both sides. In actuality, this is unfortunately exactly what is going on. The upside is that we have seen extreme increases in construction costs, as well as a historically laissez-faire approach from carriers as it relates to replacement values, and both of those things are being brought into line with these changes. This means that unless we continue to experience explosive growth in material and labor cost/shortages, this should be a fairly short-lived course correction that will theoretically have little/no long-term effects once the course correction occurs and things stabilize.

Closing thoughts – what does this mean for you?

Since we are in a hard market, which is a part of a market cycle, we will see the market soften once again eventually. The key takeaway here is to realize that the fundamentals driving this hard market are materially different than the previous drivers of other hard markets, which does remove some of the predictability as to when things will return to some sense of normal – or should I say the “new normal”. The reason that I don’t say “return to normal” when referring to insurance rates is that in some cases, those rates of 5 years ago are gone – sometimes forever. Just like how a $300/door rate was once upon a time normal, things changed, and everyone had to adjust, adapt, and overcome – the same thing that will have to happen here for some.

Now – does that mean that you are powerless in this market, relegated to the back seat where you sit and watch while it all passes you by – ABSOLUTELY NOT! In the December Edition of Premium to Principal, we are going to cover all of the things you can do to take an active role in the insurance journey for your properties, including the new carriers and programs that we have coming to the market in January 2024, and how to make your operations and properties best-in-class to get the most favorable insurance underwriting possible.

Thanks again for bearing with me through the long read, more incredible things to come!

In the meantime, here’s how Micah Mattox & Real Protect can help you:

Leave a comment