Mortgage rates top 7%, hitting 21-year high

via Yahoo Finance by Gabriella Cruz-Martinez

The bulk of this article is directed at residential but the ramifications and impact is being felt in commercial as well. Especially for the ARM mortgages or folks needing to refinance in the future.

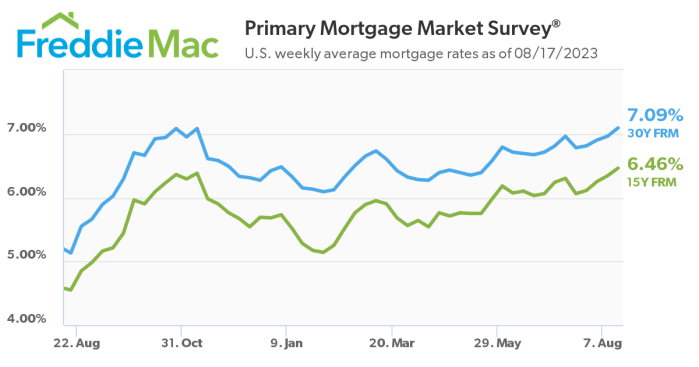

Mortgage rates surpassed 7% this week, hitting the highest level in more than two decades.

The average rate on the popular 30-year fixed mortgage increased to 7.09% this week, up from 6.96% the week prior, according to Freddie Mac’s release on Thursday. That’s the highest point since the first week of April 2002 and marks just the third time rates have exceeded 7% since then. The last times were in October and November of last year, when the rate reached 7.08%.

Rates have been on a choppy rise since the onset of the year as the Federal Reserve fights to wrangle inflation. The increase this week further deteriorates affordability for budget-conscious buyers who are facing elevated home prices and a shortage of choices because homeowners remain reluctant to sell and give up their lower mortgage rate.

“I think what we’re seeing is the Fed’s efforts to crush inflation are in turn starting to crush demand,” National Association of Home Builders CEO Jim Tobin told Yahoo Finance Live(video above). “And 7% mortgage rates are really keeping people on the sidelines [and] keeping people in their existing homes.”

Chart via Freddie Mac.com

‘Highest rates in 20 years and getting worse’

Homebuyer demand is cratering.

The volume of purchase applications for a mortgage declined by 0.8% from one week earlier to its lowest level in nearly seven months, the Mortgage Bankers Association (MBA) surveyfor the week ending Aug. 11 found. Overall, purchase demand was 26% lower than the same week a year ago.

The decline in activity was driven by the increase in rates, the MBA noted. The share of applications for adjustable-rate mortgages — which typically come with lower initial rates than fixed-rate mortgages — increased to 7%, the highest level since April 2023, further confirming that borrowers are seeking relief.

“It’s brutal out here. Highest rates in 20 years and getting worse,” Jason Sharon, owner of Home Loans Inc., told Yahoo Finance. “I believe people still want to own homes, [but there are] just so many that cannot afford it based on the combination of higher home prices and rates.”

‘If rates don’t drop sharply’

Mortgage rates will need to fall quite a bit to reverse the dynamic in today’s market, Len Kiefer, Freddie Mac’s deputy chief economist, told Yahoo Finance.

“We can’t be sure where rates may go in the future,” Kiefer said. “But if rates don’t drop sharply from today, refinance volume is likely to remain near historical low levels and the mortgage rate lock-in effect is the largest ever — further reducing already the slim inventory of for-sale homes.”

While the available inventory of unsold single-family homes increased by less than 1% for the week ending Aug. 14 to 492,000, that’s still 10% fewer than last year. And the seasonal gain may mean that more potential buyers have called it quits, according to Altos Research.

“It looks to me like one of the signals of slightly fewer buyers,” Mike Simonsen, CEO of Altos Research, wrote in a blog post. “In the first half of the year, inventory declined because demand was greater than the season would indicate. Now that extra little boost of demand seems to be gone from the housing market.”

Some short term solutions or ways to acquire are of course Cash and Seller Financing.

We still need to see Sellers expectations coming more into line with the market but the same goes for Buyers who can adjust and be flexible to changing trends and momentum.

Leave a comment