By Richard Leong via Reuters.com

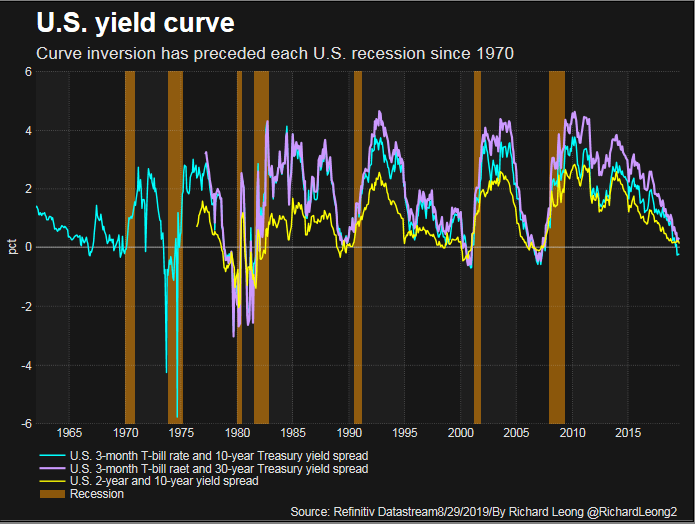

The U.S. yield curve inversion deepened on Tuesday to levels not seen since 2007, rekindling fears of a looming recession that spurred a sell-off on Wall Street and stoked even more safe-haven demand for government bonds.

The intense interest in Treasuries supported demand for $40 billion worth of two-year government debt for sale, part of this week’s $113 billion fixed-rate Treasury supply.

The yield curve often inverts prior to a U.S. recession.

“As the curve inverts further, it has inspired more long-end buying,” said Mike Lorizio, head of Treasuries trading at Manulife Asset Management in Boston.

The Treasury Department sold its latest two-year, fixed-rate note supply at a yield of 1.516%, which was the lowest at an auction of this maturity since September 2017.

The Treasury will sell $41 billion of five-year notes on Wednesday, followed by a $32 billion auction of seven-year debt on Thursday. It will also offer $18 billion in floating-rate notes on Wednesday.

On the open market, 10-year Treasury yields were 1.488%, down 5.60 basis points on the day. They reached a three-year low of 1.443% on Monday.

The yields on two-year notes were 1.531%, down 2.00 basis points. On Monday, they declined to 1.449%, the lowest since September 2017.

The three major Wall Street indexes were lower, wiping out their initial increase.

The spread on three-month T-bill rates over 10-year yields grew as wide as 52 basis points, a level not seen since March 2007, according to Refinitiv data.

The deepening curve inversion reflects investors’ nervousness about a recession and uncertainties over the trade conflict between China and the United States.

“It’s not a sign of confidence in inflation or a pickup in growth,” Lorizio said.

Leave a comment